WaveFront doesn’t launch investment products based on what the market wants, but rather how we invest our own money. The WaveFront All-Weather Fund, LP was designed to invest across multiple asset classes and strategies for maximum, stable absolute returns over the long-term. While we manage risk and trade around our core positions at higher frequencies, ultimately, we seek to identify and invest in long-term structural trends driven by deep macroeconomic and geopolitical fundamentals.

With a YTD return of +22%*, we believe we have successfully positioned the Fund for returns in the current environment. In the wake of the 2020 US Presidential Election, and assuming no exogenous geopolitical shocks, it is worth commenting on some possible long-term trends emerging from a Biden win.

The starting point to projecting forward is summarizing how we got to where we are today. Prior to the Global Financial Crisis (GFC) that began in 2007, trends in globalization, technology and fiat currency systems led to significant growth in emerging market GDP and global GDP potential. Globalization accelerated on the back of significant advances in technology and communication. These advances led to a significant outsourcing of developed countries’ manufacturing to emerging countries. Consequently, EM economies’ market share of global GDP grew, as did their population of educated, middle class workers and consumers. The emergence of fiat currency as the dominant currency system in 1971 allowed central banks to extend growth by adopting easy monetary policies and increasing the supply of money during the global growth period prior to the GFC.

While there are obvious advantages to better manage economic cycles with fiat currency systems, a key disadvantage of potentially unlimited money supply is the increased likelihood of asset bubbles and excess leverage from the misuse of fiat currencies. While not the root cause, loose money policies were a key contributing factor, along with regulatory and supervisory failures, to the subprime mortgage crises that was the catalyst of the GFC.

Exacerbating the problem though, the solution to the GFC required large-scale asset purchases by the Federal Reserve and expanded easy monetary policies. While the objective of these policies was to provide a bridge to recovery by keeping borrowing rates down and stabilizing asset prices, side effects included financial and real estate asset reflation – more accurately inflation – and, in turn, expanded social and wealth inequalities at a time when globalization was already hollowing out working class opportunities. A natural behavioral reaction to such widening inequalities is the social unrest, nationalism and populism that became globally ubiquitous, and that ultimately led to the presidency of Trump.

Without examining the merits of his policies, an obvious effect of Trump’s behavior and rhetoric was to stoke divisions both within America and in its relationship with other countries. Add an exogenous pandemic, the massive deficit spending to combat its economic devastation and a weak US government response to control the pandemic domestically and you get to where we are at today, a Biden presidency.

Looking forward, like all past pandemics, Covid is likely an exogenous event the effects of which will dissipate with time and medical solutions developed by human ingenuity and sheer effort. The global scientific research response has been dramatic in scale and speed, and emerging results are encouraging for a pandemic resolution that may now be in sight.

Setting aside the pandemic then, what are the likely structural forces and trends that are likely to follow from the US election results and a Biden presidency checked by a Republican Senate? At a government level, the market response to the US election conveys a belief in a return to a Goldilocks government driven by bi-partisan politics and centralist policies that are a bit, but not too far left. Furthermore, global relationships are likely to normalize along with a return to globalization trends in place prior to Trump’s presidency.

In particular, with its high savings rate, strong leadership and investment in education to produce both more engineers and equal or higher proficiency scores than in the US, there is little to stop China’s ascension, which will benefit both US and global GDP growth. Furthermore, while little noticed in the press so far, China made recent changes to its quota system that drastically opens up their capital markets to global investors, and they timed the announcement of this change to coincide closely with the US election.

A new vertical for growth in the Biden era should be from initiatives and investments to promote green energy and other areas to address climate change. Green energy has been an emerging trend for many years now. However, with economics now in line with those of fossil fuel driven energy, green energy trends, with an uptick in public investment and incentives, may now materially accelerate and become a dominant industry trend going forward. Similar logic points to major trends in online healthcare and biotech from increased investments in science to both prevent future pandemics and upgrade the healthcare response system.

Overall, a Biden presidency should be good for global growth from the combination of a bi-partisan Goldilocks government, a resumption of globalization, China’s ongoing rise and both US and global investment to address climate change and future pandemics.

Given this growth outlook and tilt back towards globalization, The WaveFront All-Weather Fund, LP is tilted for an eventual normalization of both bond rates and inflation expectations. Accordingly, fixed income durations have been shortened and continue to be inflation-linked. Gold remains a key holding, both for inflation normalization and as an alternative currency given the ongoing experiment with Modern Monetary Theory. Risk exposures are below normal due to current valuations and are tilted towards Real Estate and Chinese equities. Managed Futures exposure are also at full weight to provide both diversification and a multi-asset class momentum exposure that should benefit from a return to more persistent global growth trends.

*YTD returns as of October 31, 2020.

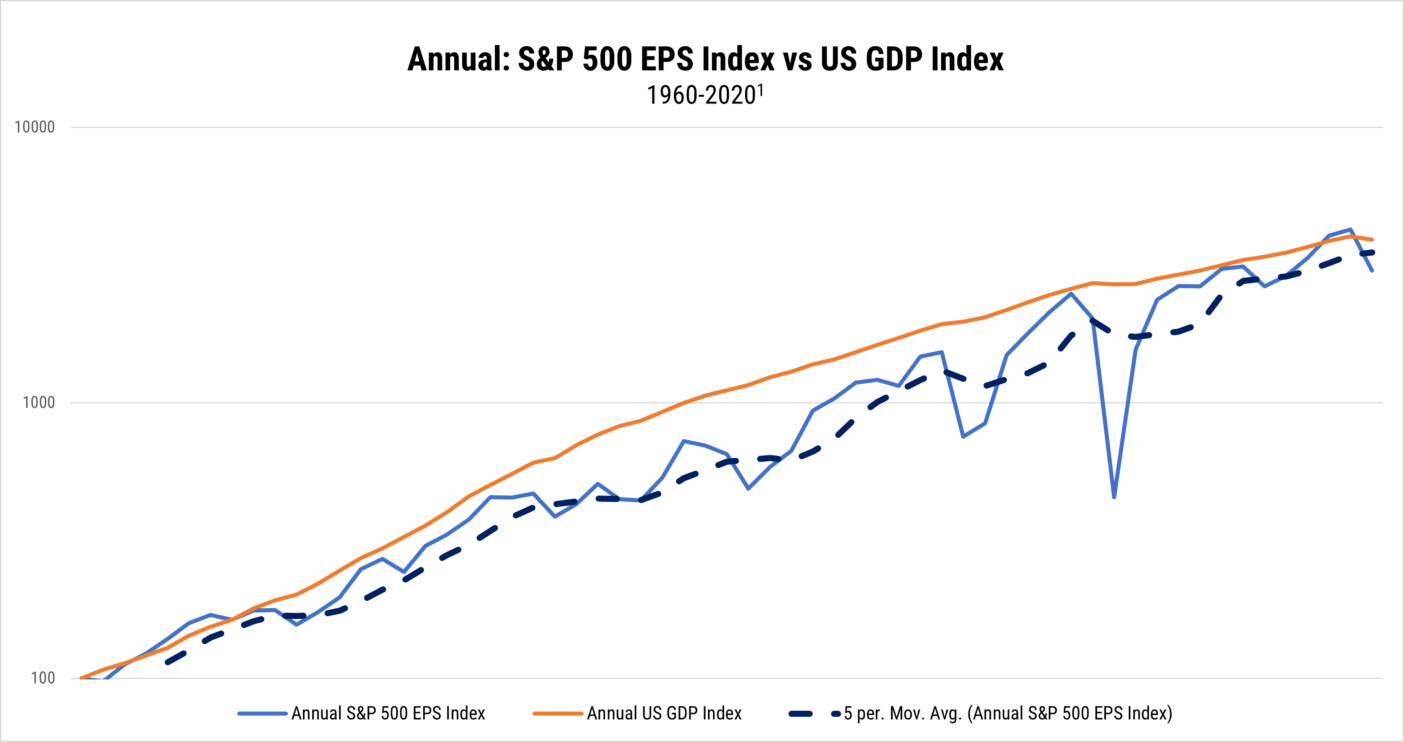

1 - Source for GDP Data was Federal Reserve Bank of St. Louis Economic Data (FRED), and source of EPS Data was Robert Shiller