Quantitative investment management uses data analysis techniques, similar to those in natural sciences, to predict market movements and create innovative trading strategies. This approach leverages scientific methods to enhance your investment portfolio's performance. Let's dive into why this matters and how it works.

Experimental vs. Observational Science

Understanding the distinction between experimental and observational investigations is crucial for quantitative investment management. This concept is borrowed from the scientific process, where experiments can be repeated multiple times to generate large datasets with comparable results. For example, in physics, particle accelerators smash protons together to observe how often a particle is produced. If more data are needed to precisely measure particle production, the process can be repeated until the desired precision is reached, potentially generating billions or trillions of data points.

In contrast, consider an astronomer studying gravitational waves produced by colliding black holes. The astronomer observes as many actual collisions as possible and theorizes about the resulting waves. However, it's impossible to create a large number of comparable black hole pairs to observe their collisions. The scarcity of black holes means the sample may not be representative, leading to biases. In this observational approach, astronomers must work with the available data, correct for biases, and draw conclusions from limited information. Experimentation and observation are not rigid dichotomies but rather points on a continuum. The ability to control and repeat data creation moves a study towards the experimental end, while smaller, biased datasets with less control lean towards the observational end.

Application in Finance

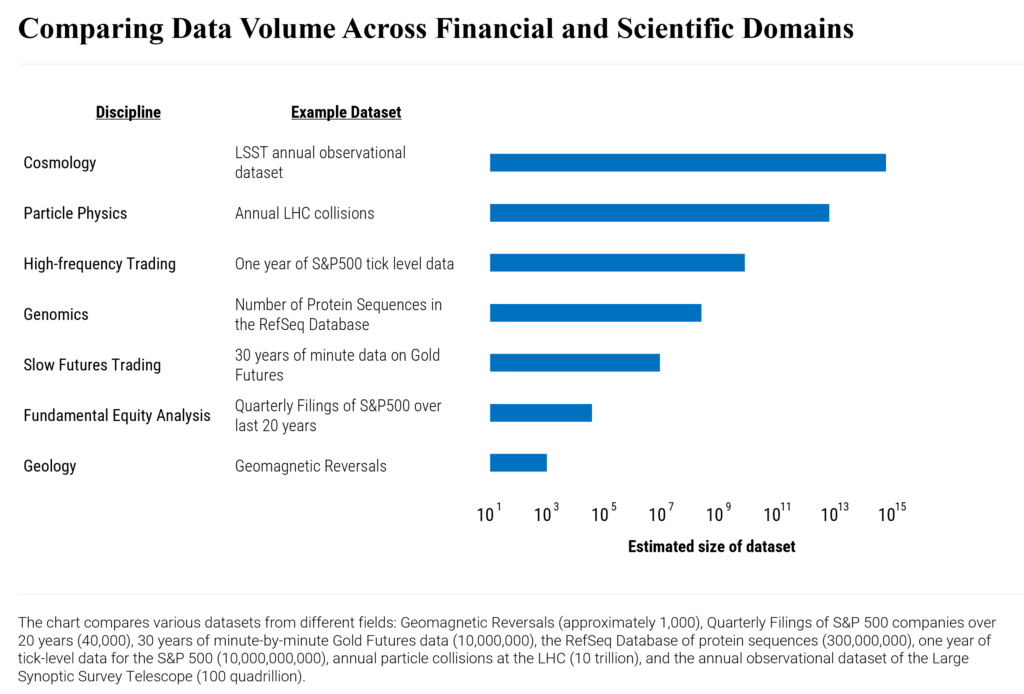

This distinction extends to finance. For instance, an execution algorithm can be tested experimentally by applying it to additional trades. However, a theory about stock-market crashes can only be studied observationally, relying on data from past crashes, each with unique circumstances. Generating more crashes on demand is not feasible. Financial datasets also vary widely in size, similar to scientific datasets. Long-term fundamental investors may only have a few hundred data points since most listed companies release quarterly financial statements. Conversely, high-frequency traders process price data stamped to the nanosecond, creating datasets comparable in size to those used in particle physics.

Practical Implications

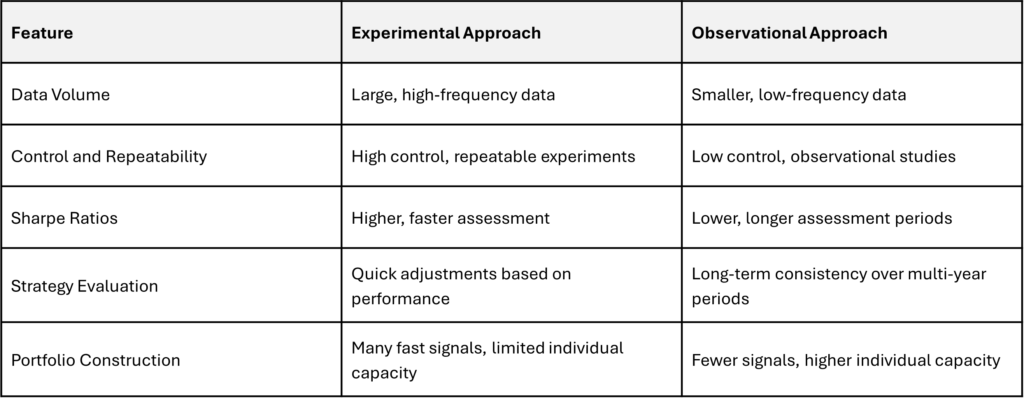

Faster trading signals are more suited to experimental approaches due to their higher expected Sharpe ratios, allowing quicker evaluation of performance. For instance, if a signal with a Sharpe ratio of 1.8 produces losses after a few months, it indicates a potential issue, such as being arbitraged out. The signal can be discontinued, and a new experiment initiated. In contrast, a strategy with an estimated Sharpe ratio of 0.4 might experience multi-year losses, yet it wouldn’t be rational to abandon it based on performance alone, as such losses align with its long-term statistical distribution.

Experiment vs. Observation in Quantitative Investment

Experimentation and observation represent two approaches to quantitative investment. The experimental method seeks faster strategies with higher Sharpe ratios, which individually have limited capacity due to frequent trades and associated transaction costs. The goal is to build a large portfolio by combining numerous fast signals.

Alternatively, observational approaches seek signals with higher capacity and generally lower Sharpe ratios. Fewer signals are needed to construct a large portfolio, provided they have low correlations with each other.

As in science, the experimental-observational spectrum offers a useful framework for understanding different quantitative investment methods.

This framework helps in understanding the diverse methods employed by quantitative investment managers.

How Does Quantitative Investment Work?

Quantitative investment management involves using rules-based trading systems to analyze vast amounts of data. These systems identify market trends and make investment decisions based on that data. By diversifying across various markets and timeframes, these strategies aim to deliver consistent returns.

The Benefits of Quantitative Investment Strategies

- Enhanced Diversification: Quantitative strategies provide exposure to a wide range of asset classes, including stocks, bonds, commodities, and currencies. This diversification helps reduce risk and improve returns.

- Scientific Approach: These strategies use data-driven methods to make investment decisions, reducing emotional biases and improving consistency.

- Adaptability: Quantitative strategies can quickly adapt to changing market conditions, protecting your investments during volatile times.

The Challenge of Selection Bias

At WaveFront, our research often begins with a hypothesis. We search for data to test this idea, aiming for low correlation to existing strategies and a positive Sharpe ratio. While finding just a handful of uncorrelated signals, each with a positive Sharpe ratio, can lead to a portfolio with outsized risk-adjusted returnd, achieving this in practice is challenging due to selection bias.

Imagine creating 100 random trading signals with no predictive power. Their back-test performance forms a distribution, and some will appear to have positive Sharpe ratios by chance. If we select only those with positive historical performance, we create a portfolio that looks good in backtests but may have a Sharpe ratio of zero or less in reality, once transaction costs are included.

Selection bias is pervasive in research. Researchers test numerous ideas, and although they are not generated randomly, we cannot know in advance whether they will work. Even good ideas can be partly the result of luck, leading to overestimated Sharpe ratios. This bias is ingrained in many organizational cultures, where employees present only their best results and discard less successful ones. Adjusting model parameters until they work further compounds the issue.

Addressing selection bias requires an organizational-level approach. This involves creating a research framework that mitigates bias, ensuring that findings are robust and reliable. At WaveFront, we employ rigorous testing and validation processes to achieve this.

Conclusion

Quantitative investment managers operate on a spectrum. On one end are higher-frequency strategies with experimental approaches, higher Sharpe ratios, and lower capacities, relying on large datasets and machine learning. On the other end are slower systems with lower transaction costs, observational approaches, lower Sharpe ratios but higher capacity, and a focus on extracting signals from small, noisy datasets.

Why Choose WaveFront Global Asset Management?

WaveFront Global Asset Management is a pioneer in quantitative absolute-return investment strategies. Based in Canada, we have a strong track record of innovation and performance. WaveFront’s quantitative investment strategies have been developed through decades of research and experience through many market cycles. Our dedicated focus to applying a data-driven, scientific approach to investing has allowed us to develop innovative strategies that seek to deliver superior long-term investment performance for our clients.