Robert Koloshuk, WaveFront's CIO (Chief Investment Officer), discusses the reasons why 'lookback periods' are not a productive investigation into Managed Futures strategies, and how WaveFront's approach is different.

At WaveFront, we’ve been at the forefront of Managed Futures trading for over 20 years. Our Chief Investment Officer, Robert Koloshuk, has been a pioneer in this field since the launch of the WaveFront Global Investment Program in 2007. His research into futures markets goes back even further, and his experience has guided our research staff through many valuable lessons. Here we discuss the pitfalls of relying too heavily on optimized lookback periods in trend-following strategies.

The Dangers of Optimization: A Cautionary Tale of Overfitting

Early in our firm’s history, we encountered the dangers of overfitting. In 2005, I met a CTA (Commodity Trading Advisor) eager to show me his trading model. He presented impressive metrics: a Sharpe ratio nearing 3, annualized returns around 40%, and almost no drawdowns. However, his model was built on carefully selected parameters, optimized for each market based on what he claimed was extensive research. When I probed, he admitted his research focused mainly on finding the best lookback periods to generate those results.

The Optimization Trap: What We Learned

To illustrate a point, I replicated his methods using a similar model but excluding the last five years of data. The results were impressive, nearly matching his claims. Then, I applied the same parameters to out-of-sample data from the final five years, which hadn’t been included in the optimization. The Sharpe ratio fell to below 1 and the maximum drawdown exceeded 35%. When I suggested we conduct further out-of-sample testing on his model, he vanished. I don't believe he was trying to deceive us—he was just having a hard time coming to terms with the limitations of his approach after committing so much effort to it. On the bright side, it could have been worse if real capital had been committed.

This, and many similar experiences, have confirmed that optimization of lookback periods is of little to no value. At WaveFront, we've spent years testing, and ultimately rejecting, traditional and walk-forward optimizations for our models. Instead, we base our strategies on sound theories about the fundamental drivers of return and we eschew overfitting to the past.

Backtesting vs. Optimization: Understanding the Difference

Backtesting itself is not the enemy—it’s a vital tool that allows us to test hypotheses and validate trading strategies. Much of what we do is a form of backtesting. For instance, if we believe that markets trend upwards when in backwardation, because carrying costs embed a bullish risk-premium, then we can test this hypothesis with backtesting. The key is to ensure that the problem is reducible to an algorithm that accurately reflects the real-world mechanics of the market.

WaveFront’s Approach: Grounding Strategies in Fundamentals

At WaveFront, our approach to managed futures trading is grounded in sound fundamental principles rather than mere reliance on backtesting and optimization. We believe that a hypothesis must be testable and rooted in a real-world understanding of market behavior. Our strategies are developed from theories about market mechanics and then validated with empirical data. Our research-driven approach ensures that our models are not only robust, but also adaptable to changing market conditions.

Effective trading models need to be grounded in solid fundamental frameworks, and they should operate on 'a priori' logic—built from first principles. WaveFront’s models autonomously select parameters, analyzing markets for statistical biases, and then apply logic to exploit these biases whether they are long or short. Our analytics use the market's entire historical data every time prices update, avoiding the pitfalls of overfitting to lookback periods.

Putting Theory to the Test: A Real-World Example

The common mistake of overfitting to specific lookback periods in systematic strategies throughout the last 2 decades has led to many foundational papers warning of the dangers of overfitting and data mining. Overfitting has become so prevalent that it has become a commonly used rule of thumb to look at any backtest and discount key metrics of a strategy by 50% or more to account for the overfitting (Harvey and Liu, 2015)1.

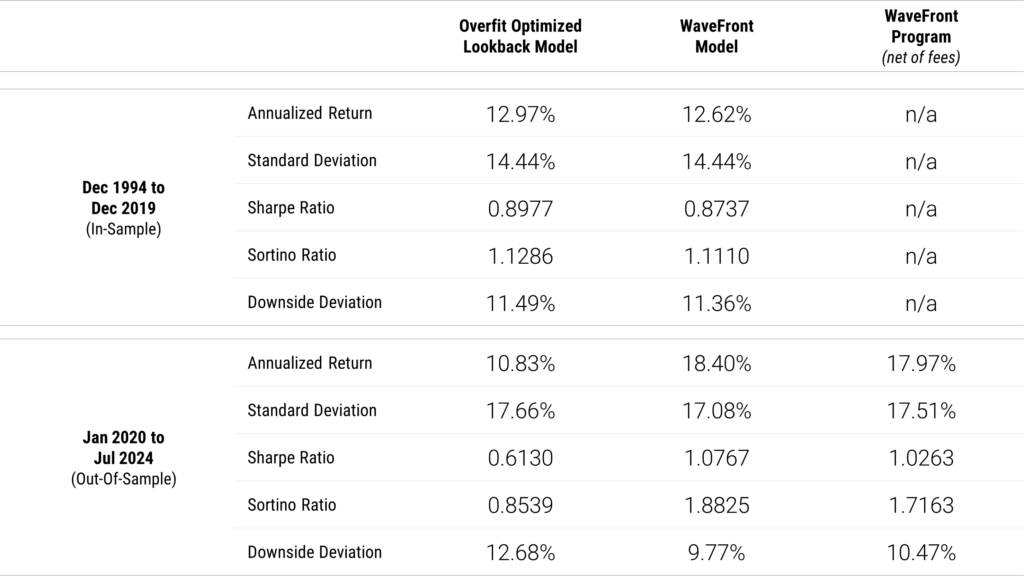

To illustrate this, we revisited the type of optimization experiment that I conducted back in 2005. Rather than allow for hyper-optimization, as I did back then, we tested a very practical, simple moving average crossover strategy on 60 through 400-day lookback periods in 5-day increments. We ran these 70 tests each on 25 of the most liquid USD-denominated futures contracts 2. We used WaveFront’s risk-parity framework to get our relative position weights, and then we used a 60-day rolling window to target the portfolio to a 15% volatility level. We also factored in a 1% management fee, a 20% performance fee, and a 2% drag for slippage, commissions, and administrative costs into all the model results below:

Data Source: WaveFront & Bloomberg

Overfit Optimized Lookback Model (In-Sample from Dec 1994 to Dec 2019): These results are respectable, considering the inclusion of the challenging 2016-2019 period for Managed Futures. The results would have been better had we been fitting to a shorter timeframe, or if we had included more than one parameter and permitted flat exposures. Our optimized moving average crossover was always invested, and this strategy would be very practical to implement in the real world - with no unreasonably short-term trading activity.

Overfit Optimized Lookback Model (Out-Of-Sample from Jan 2020 to July 2024): Returns dropped considerably in the recent 5-year

out-of-sample period. This is notable given that it has been a very good period for Managed Futures. Portfolio volatility targeting was unable to constrain volatility to 15% due to the large swings in the markets over the period, which is not uncommon for most strategies during this timeframe.

WaveFront Model (Dec 1994 to Dec 2019): Our model results are respectable considering the inclusion of the challenging 2016-2019 period for Managed Futures. Although we started trading a model very similar to this one with the launch of the Global Program in 2007, our live performance was significantly worse over this period due to a bond yield overlay between 2015 and 2019.

WaveFront Model (Jan 2020 to July 2024): While it has been a common approach to intentionally overfit parameters using in-sample data, and then use a subsequent method to discount the performance to see if the results are consistent with out-of-sample testing, the superior method is to avoid the initial process of overfitting altogether. WaveFront’s de-parameterized model consistently delivered superior returns, even to its own returns from the preceding 25 years, since January 2020.

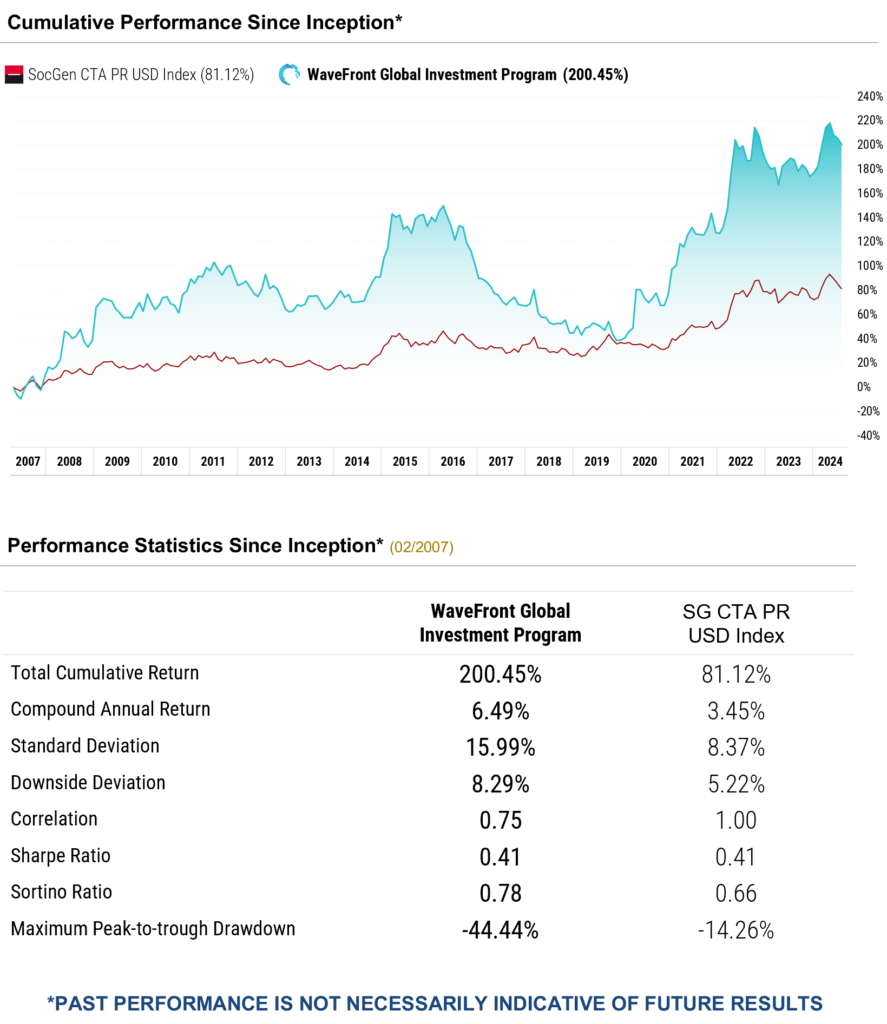

Real-World Success: WaveFront Global Investment Program

Comparing these models to WaveFront’s real-world performance, the WaveFront Global Investment Program, delivered returns in this period were nearly identical to our model, demonstrating the strength of our approach – an approach that doesn’t rely on lookback periods! This real-world validation highlights the efficacy of our research, grounded in fundamentals and free from the constraints of mere optimization.

WaveFront Global Investment Program

A Legacy of Research and Innovation

WaveFront’s success is built on decades of dedicated research, close collaboration with academia, and a team singularly focused on Managed Futures. We believe in trading models that are not just theoretically sound but are also rigorously tested and continually refined. This commitment to innovation is reflected in our consistent performance and leadership. Since (Robert Koloshuk) taking controlling interest of the firm in 2019 and as CIO, I've ensured our trading models align entirely with our core research principles. The results speak for themselves, demonstrating the power of a disciplined, research-driven approach.

Looking Ahead

While we cannot predict market conditions with certainty, we are confident in our ability to deliver the diversification benefits that Managed Futures can provide. Our track record is a testament to our rigorous research and unwavering dedication to our strategy. As the market evolves, so will our commitment to staying ahead.

Footnotes:

1. The paper by Campbell R. Harvey and Yan Liu (2015) discusses the issue of overfitting in the context of backtesting trading strategies. They highlight how data mining can lead to inflated Sharpe ratios and propose a statistical framework to account for multiple tests, ensuring more reliable performance metrics.

2. The chosen lookback periods for the respective assets were as follows:

- Australian Dollar: 390 days

- Brent Crude: 75 days

- Soybean Oil: 135 days

- British Pound: 225 days

- Corn: 60 days

- Cocoa: 185 days

- Canadian Dollar: 265 days

- Crude Oil: 140 days

- Cotton: 200 days

- US Five Year Note: 225 days

- Gold: 355 days

- Copper: 90 days

- Heating Oil: 70 days

- Japanese Yen: 70 days

- Coffee: 255 days

- Natural Gas: 160 days

- Platinum: 120 days

- Gasoline: 95 days

- Soybeans: 145 days

- Sugar: 65 days

- Silver: 395 days

- US Ten Year Note: 345 days

- US 30-Year Bond: 165 days

- Wheat: 200 days

- Gasoil: 60 days

Disclaimer:

Past performance is not necessarily indicative of future results. Futures trading is speculative and involves substantial risk. Potential investors should note that the value of an investment may go down as well as up. There is a risk that an investment will be lost entirely or in part. An investment in the Program is speculative and involves a high degree of risk and is not intended as a complete investment program. There is no guarantee of trading performance. An investment should only be made after consultation with independent qualified sources of investment and tax advice. This communication is not and under no circumstances is to be construed as an invitation to make an investment in any WaveFront program nor does it constitute a public offering to sell a fund or program. Investors should review the Offering Documents of any WaveFront Program or Fund in their entirety for a complete description of WaveFront’s programs or Funds. Applications to investwill only be considered on the terms set out in the Offering Documents. The information in this material is subject to change without notice and WaveFront will not be held liable for any inaccuracies or misprints.

The Monthly Rates of Return above are the composite weighted net returns of all client accounts of WaveFront managed pursuant to the WaveFront Global Investment Program, computed pursuant to methodologies approved by the U.S. Commodity Futures Trading Commission (CFTC).

The performance results presented in this article are based on historical backtesting and are hypothetical in nature. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any portfolio or investment strategy will or is likely to achieve profits or losses similar to those shown.

- Hypothetical Limitations: The hypothetical performance results do not represent actual trading and may not reflect the impact of market factors, including liquidity, slippage, and transaction costs, that could affect investor returns.

- Backtested Results: The backtested results use specific lookback periods and historical data to simulate performance. However, past performance is not indicative of future results, and the models used in backtesting can change over time.

- Market Conditions: Financial markets are subject to a range of unpredictable events and external factors, such as economic news, global events, and market sentiment, which can impact the actual performance of investment strategies.

- Risk of Loss: Investing in financial markets involves risks, including the potential loss of principal. No guarantee is made that the strategies discussed will lead to profitable results or that investors will not incur losses.

- For Informational Purposes Only: This information is provided for informational purposes only and should not be construed as investment advice or an offer to buy or sell any security or financial product. Investors should conduct their own research and consider their financial situation and investment objectives before making investment decisions.

- Professional Advice: It is recommended to seek advice from a qualified financial advisor to understand the risks involved with investing in the markets and to ensure that the investment strategy aligns with your investment goals and risk tolerance.